Table of Contents

What is a Fair Value Gap (FVG)?

A Fair Value Gap, or FVG, is a 3‑candle pattern signaling a market imbalance. During a sharp move (impulse), price leaps without trading through a range, leaving behind a “gap.” This often indicates institutional orders creating inefficiencies that price later tests.

- Bullish FVG: Formed when a strong green candle leaves a gap between the high of candle‑1 and the low of candle‑3. Price often retraces into this gap before continuing higher.

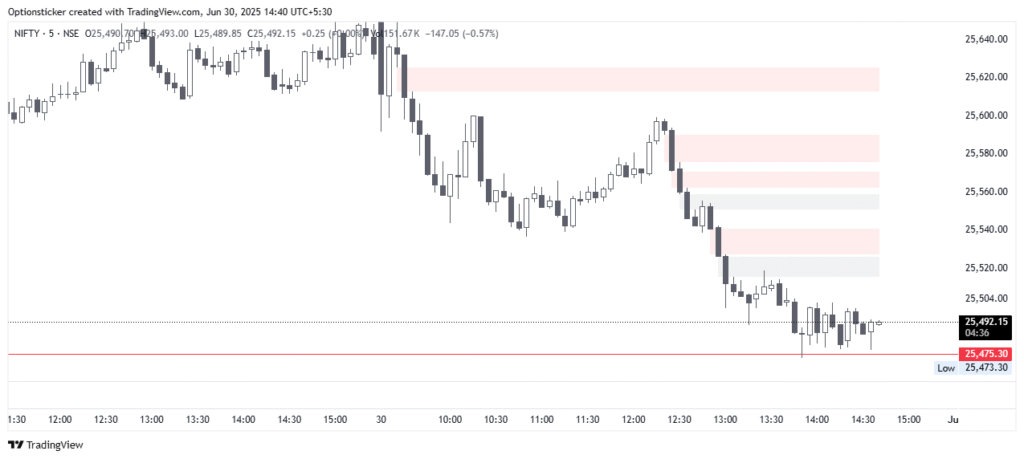

- Bearish FVG: Occurs when a big red candle leads to a gap between candle‑1 low and candle‑3 high — signaling potential resistance on a rebound .

If traded with the right structure and filters, FVGs can provide highly accurate trade entries.

In this guide, you’ll learn a complete 7-step process to trade only the highest-probability FVG setups.

1. Align with Market Structure

Trade only in the direction of the trend.

- In a bullish market, focus on bullish FVGs that support higher highs and higher lows.

- In a bearish market, use bearish FVGs that align with lower lows and lower highs.

This ensures you’re flowing with momentum and not against institutional order flow.

2. Avoid Mitigated FVGs

If price has already touched an FVG (even slightly), it’s considered mitigated and less reliable.

Trade fresh, untouched FVGs for better performance.

3. Use Discount and Premium Zones

To improve your trade accuracy:

- Mark the swing high and low.

- Draw the 50 percent midpoint.

Now split the range:

- In bullish trades, target FVGs below the 50 percent line (discount area).

- In bearish trades, target FVGs above the 50 percent line (premium area).

This gives you better entries with higher reward potential.

4. Use Multi-Timeframe Confluence

Big FVGs on higher timeframes like 4-hour charts show major zones but can be too wide for precision entries.

Zoom into lower timeframes like 15-minute charts and look for a smaller FVG inside the larger one. This gives a tighter, smarter entry zone.

5. Pay Attention to the Third Candle

The third candle that completes the FVG tells you everything.

- If it’s impulsive and in the direction of the trend, it forms a breakaway FVG. These are strong.

- If it reverses or rejects, it forms a rejection FVG. These are weak and best avoided.

Stick to breakaway-type FVGs for stronger follow-through.

6. Trade FVGs Around Liquidity Events

Watch how price behaves around key swing highs or lows.

- If price blasts through a liquidity level, it’s called a liquidity run. Very strong FVGs often form inside this move.

- If price tests but fails to break a level, it’s a liquidity sweep. This may signal a reversal. Avoid bullish trades here.

7. Skip FVGs During Consolidation

FVGs are most effective during trends. In ranging or choppy markets:

- FVGs often fail or reverse quickly.

- If both bullish and bearish FVGs keep failing, you are likely in a consolidation zone.

Wait for price to break out and respect two new FVGs in the same direction before re-entering.

Strategy Blueprint

Here is a simple step-by-step checklist:

- Identify the trend (bullish or bearish)

- Scan for untouched FVGs aligned with the trend

- Confirm the FVG is in a discount or premium area

- Drill into lower timeframes for a more precise entry

- Ensure the third candle is strong and in trend direction

- Use liquidity runs as confirmation, and avoid sweeps

- Do not trade in consolidation zones

Why This Works

FVGs highlight areas where institutions moved the market quickly and aggressively, leaving behind unbalanced price zones. These gaps often get retested, and by applying the right filters, you can trade only the most reliable ones.

This strategy works because it blends:

- Trend structure

- Value pricing using discount and premium zones

- Liquidity context

- Multi-timeframe precision

Final Thoughts

This 7-step FVG method gives you a structured, disciplined approach to reading market imbalances. Whether you follow price action or smart money concepts, this strategy offers clarity and consistency.