Understanding the components of an option’s premium is critical for traders. In this guide, we break down intrinsic value and time value (extrinsic value) using real-world examples.

Table of Contents

1. What Are Intrinsic and Time Value?

- Intrinsic Value:

The real, tangible value of an option if exercised immediately.- Formula:

For Call Options: Current Asset Price – Strike Price (if positive; otherwise, zero).

For Put Options: Strike Price – Current Asset Price (if positive; otherwise, zero). - Example:

If State Bank of India (SBI) trades at ₹245 and you hold a ₹200 call option:

Intrinsic Value = ₹245 – ₹200 = ₹45.

- Formula:

- Time Value (Extrinsic Value):

The speculative premium paid for potential price movement before expiry.- Formula:

Total Option Premium – Intrinsic Value. - Example:

If the ₹200 SBI call trades at ₹46:

Time Value = ₹46 – ₹45 = ₹1.

- Formula:

2. Key Observations

| Strike Price – ₹245 | Option Premium | Intrinsic Value | Time Value |

|---|---|---|---|

| ₹200 (ITM) | ₹46 | ₹45 | ₹1 |

| ₹220 (ITM) | ₹29 | ₹25 | ₹4 |

| ₹245 (ATM) | ₹12 | ₹0 | ₹12 |

| ₹260 (OTM) | ₹7 | ₹0 | ₹7 |

Insights:

- ITM Options: High intrinsic value, low time value (e.g., ₹200 call).

- ATM Options: Zero intrinsic value, highest time value (e.g., ₹245 call).

- OTM Options: Zero intrinsic value, time value decreases with distance from current price (e.g., ₹260 call).

3. Why Time Value Matters

- Maximized at ATM:

ATM options have the highest time value because their outcome is most uncertain. Traders pay for the probability of the asset moving favorably. - Decays with Time:

Time value erodes as expiry approaches (theta decay). This is critical for short-term traders. - Speculative Play:

OTM options (e.g., ₹260 SBI call) derive their entire premium from time value, making them “lottery tickets” for large price swings.

4. Intrinsic Value at Expiry

- European-Style Options (India):

Cannot be exercised early. At expiry:- Only intrinsic value matters (time value = 0).

- Example: If SBI closes at ₹260, the ₹200 call pays ₹60 (intrinsic value). The ₹260 OTM call expires worthless.

5. Practical Implications for Traders

- ITM Options:

- Best for conservative strategies (high intrinsic value cushions losses).

- Lower reliance on time value decay.

- ATM Options:

- Ideal for volatility plays (high time value).

- Requires precise timing due to theta decay.

- OTM Options:

- High-risk bets on large price moves.

- Cheap premiums but low probability of profit.

Key Takeaways

- Intrinsic Value = Real, existing profit if exercised now.

- Time Value = Cost of potential future gains (speculative).

- ATM Options: Most sensitive to time decay; highest extrinsic value.

- OTM/ITM: Balance risk-reward based on market outlook.

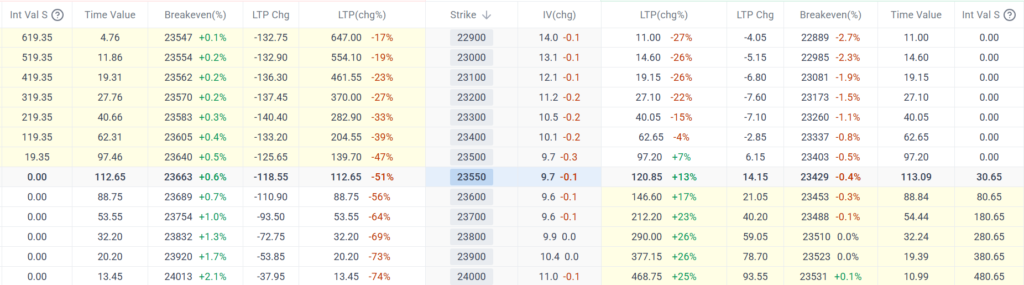

For live data, analyze option chains on platforms like NSE India or Zerodha.

Thank you for reading! Master these concepts to refine your options strategy and manage risk effectively.